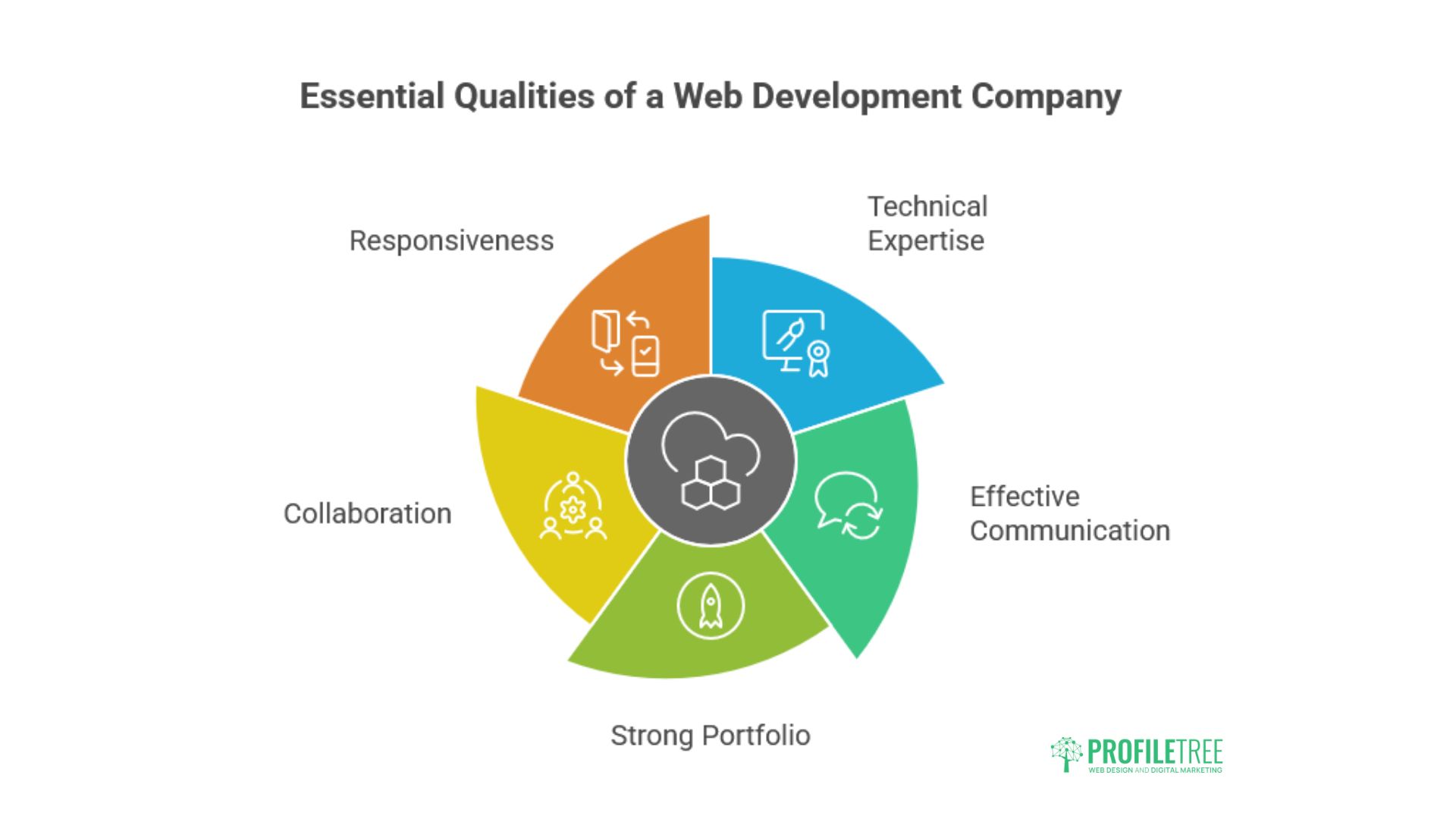

Web Development Company Guide: 10 Must-Have Qualities to Look For

Choosing the right web development company is crucial for translating your digital vision into a successful online presence. Whether you’re launching a new website or revamping an existing one, the quality of your web development partner...